The Workhorse Fixed Asset Information Management System allows for easy entry of all fixed asset information, including additions, transfers, and disposals. The user can choose to store the original cost, replacement cost, book value, and both current and accumulated depreciation for each asset. Assets can be summarized or listed by asset number, physical location, department, or asset category. An annual schedule of asset changes can be printed for the auditor's use. The system can automatically calculate and post annual depreciation.

Price: $2,800.00

Features

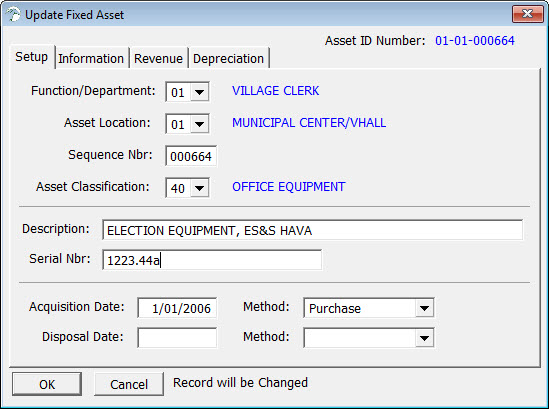

- Online entry of fixed asset information including additions, transfers, and disposals

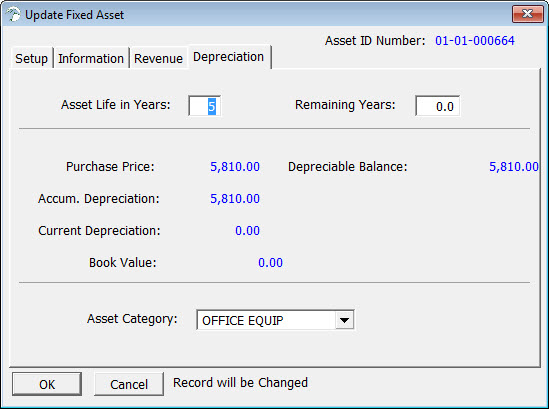

- Store original cost, replacement cost, book value, and both current and accumulated depreciation for each asset

- List assets by asset number, physical location, or department

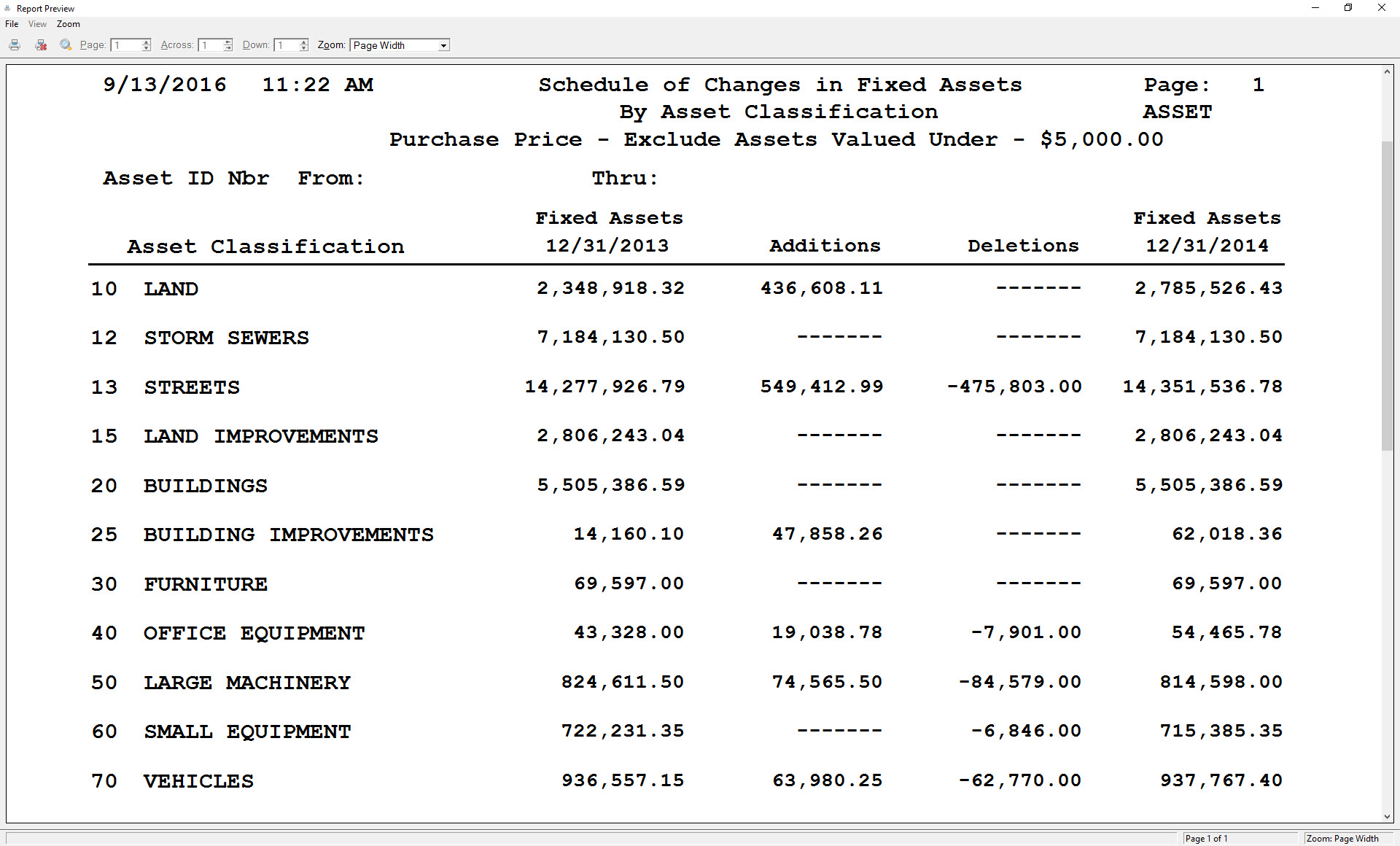

- Print a schedule of changes in fixed assets for a given year

- Automatically calculate depreciation

Price includes license, installation, and online training. (Contact us for specific pricing @ sales@workhorsewi.com)

For annual support costs, please see the support policy.